Competitive Benefits Between Leasehold Vs Freehold

Table of Contents

“Is this a leasehold or freehold property”. As a real estate profession, whenever I bring the buyer to view a private property, the question from seven out of ten of the buyer will be as above.

Private resident property in Singapore generally can be categories into two broad areas. The leasehold and freehold. In leasehold, most of the property can be either 99, if not 999 years.

So, which is better? Leasehold or freehold. I think this is a straightforward Answer. Of cause is freehold. It is a response that does not require too much thinking.

Technically, the freehold land, the owner can hold it forever, with no end-date to it. He can also, if he decided to do so, pass that ownership to the next generation and after.

999 leasehold, is somehow similar to freehold. The end date of the property has 1000 years before the lease ended. The owner can therefore able to pass down to 10 generations.

Why are buyers so concern about the tenure of the property, rather than the land? Do leasehold and freehold matter? To me, it does make some implication, but land tenure should not be the critical consideration when buying any property

Let us now dive into more detail on the pro and cons of both leasehold and freehold (I will categorize 999 years leasehold with freehold)

Freehold during Collective Sales

When a project is undergoing a collective sales (or, it is more layman to call it as En-bloc sales) process, which is an option that normally benefits the owner from a financial perspective.

In any collective sales, the project will normally be over 10 years of age from TOP. some of which might go as high as 30 years of age.

Lease Top-Up

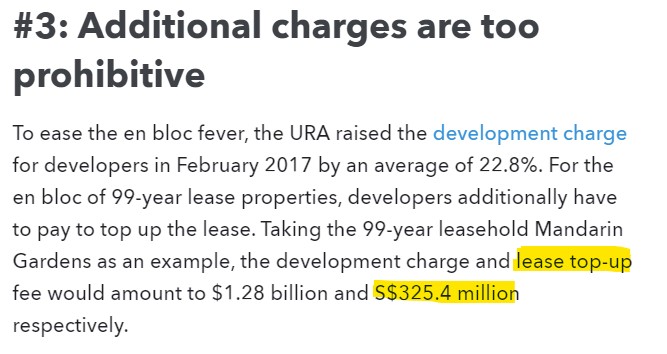

Developers who involved in the collective sales will have to top-up the lease, to bring it back to 99 years. So as the value of the property is at the market when they start selling it. This top-up amount can be as high as hundreds of million.

Taking Mandarin Gardens, for example, the project has passed its 34 years of age as of 2020. The developer, in addition to the purchase of the land, will have to pay a lease top-up fee of over $300 million

With that into consideration, the developer will either offer a lower price to the current owner or potentially sell at a higher price to new development. My personal take for this is, I will rather buy low, rather than trying to sell high after development

Appreciation rate

While touching the pulse of the property market. I realize the appreciation rate of leasehold property has interesting came higher than freehold property

Statistically, it was also second to my groundwork. One of the key reasons, I felt is, there is more leasehold property as compare to freehold. Most of the leasehold property land today is closer to the key transport hub, shopping mall, and other amenities

Financing on leasehold property

With the remaining lease of the property going lesser and lesser, the government will realized obtaining the loan became more and more challenging.

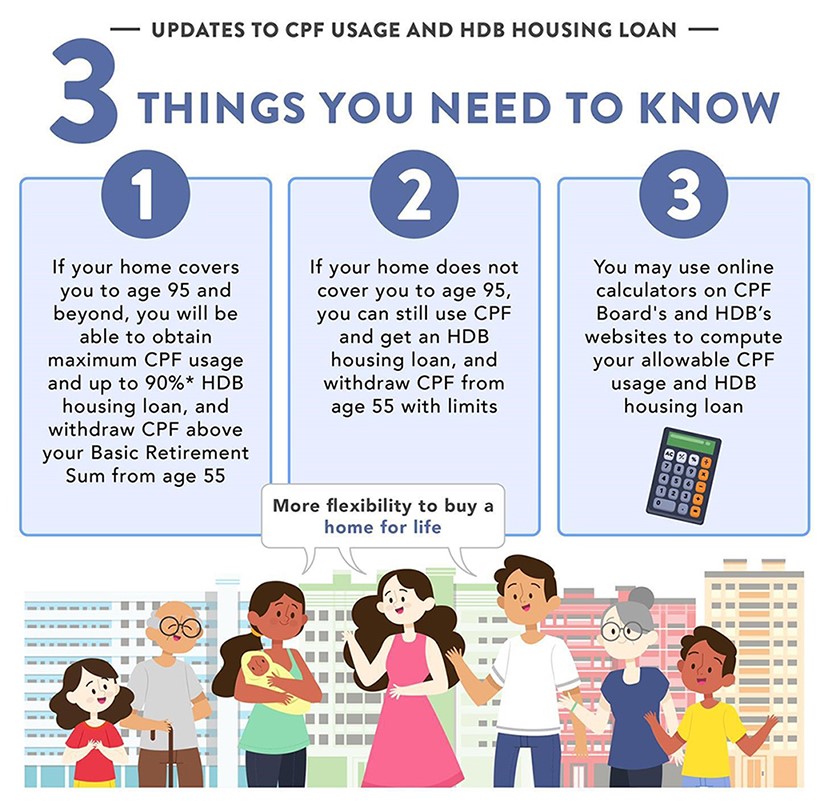

Therefore, The National Development and The Ministries of Manpower, has on the 10th May 2019 updated the rules on both HDB (Housing and Development Board) and CPF (Central Provident Fund) on the usage fund in OA (Ordinary Account).

The key changes to the rule are, the total CPF can be used will depend on the remaining lease of the property and the age of the youngest buyer. This is, the remaining lease of the property must able to cover the youngest buyer to the age of 95.

In additional to above, NO CPF is allows to be used, if the remining lease of the property is less then 20 years.

The remaining lease is more than 20 years for those properties, but it does not cover the youngest buyer to the age of 95. What happens? The CPF used will be pro-rated accordingly by the authority.

Continue transfer of ownership

All properties, be it leasehold or freehold. The transfer of ownership is possible. Why was this being taken as consideration was, for a leasehold property, especially 99 years leasehold property? The effective stay-in period is less than 90 years.

Why is it lesser? The reason being that the development will take a few years before the owner starts to move in and stay. The leasehold property lease starts when the land is sold, not when TOP (Temporary Occupation Permit) or CSC (Certificate of Statutory Completion).

Therefore, when the transfer of ownership going to happen, we will need to look into the remaining lease. It might just for two-generation and this might not be enough, especially for landed property, which normally will pass on by generation.

For freehold property, the above consideration will not be required. It can be passed on generation after generation. The taking over a generation can then continue to do any renovation, Additions, and Alterations works (A&A) or rebuilding to upkeep the property.

I will hereby want to put a caveat here, Singapore does have the LAND ACQUISITION ACT (CHAPTER 152). Whereby the private land can be acquired by necessary authority for the purpose of public purposes

Rental Yield

Having to share above, the various benefit of buying freehold property over leasehold property. Is it true that there is nothing comparable between both?

The answer is no, there is still benefit, if not equal fairness on both freehold and leasehold.

Rental Yield, for example, the tender age of the property has a minimum, if not no impact on the rental yield. One of the key parameters when it comes to rental is the amenities.

As we all aware, most of the units being rented out are taken by foreigners. Since this is not their homeland, they will be looking at accessibilities to malls, public transport, and rental amount.

Investor

In property investment, or any investment. There are long-term and short-term investors. When it comes to property investment, many of the investors are more looking at the short term. This group of investor are looking at a “hit and go” type of approach

As Singapore property transaction has SSD (Seller Stamp Duty), whereby the property purchased if sold within three years, there is an SSD imposed a minimum of 4% on the actual transacted value or market value whichever higher. There will be a minimum holding period of the property. This can be overcome when they bought a brand new property

During the brand new unit’s purchase, the investor will start to make their progressive payment, which is not the full repayment. By the time the unit got its TOP, it will likely be approaching the third year.

They will now sell the unit in the open market and profit from the sales without liable for the SSD. Assuming the market is in a healthy state.

Conclusion

There are generally two categories of buyers: buying for own stay, and the second type buying as an investment.

Be it which categories you are. My most humble suggestion is to look at the property with the following priorities

Amenities

You can do any renovation for your property, but you can’t bring an MRT station, bus interchange, or mall near your place. You might be driving today, but there will come a time that you want to hop onto public transport.

Potential Growth

What and how to determine that. My suggestion will still be the development of the area you bought. If there are a transport hub or mall around, the chances of your property dropping below market value are very slim.

This is also the same selling point, in the event you wanted to sell your property

Leasehold or Freehold

I have shared earlier, and both freehold and leasehold are comparable unless you really wanted to hold the property generation after generation.

If you have any more queries. Do contact me now. Click here to send me a WhatsApp.

Not forgetting, leasehold or freehold is the age of property, but to move ahead, there are more to consider.

Let discuss and see what option you have. Property Wealth Planning if what you need, not just buying and selling