What will the future of real estate be POST CoVid-19?

Table of Contents

What Will The Future Of Real Estate Be POST CoVid-19?

CoVid-19 pandemic, a term that has induced fear in people since the beginning of the year 2020. They have been an increase in the number of both infected patients and deaths. people are all grounded at home, people are working from home, and more… … …

No one knows, when this will be over as WHO (World Health Organization) warned on 13th May 2020 that, “The New Coronavirus may never go away”

Despite the fears that are present, we have no control over the departure of the Coronavirus, instead, we would have to adjust and adapt to the new lifestyle. What are the potential changes we would face and the impact, especially on the real estate market?

What Are The Changes During Covid-19

Shopping from HOME

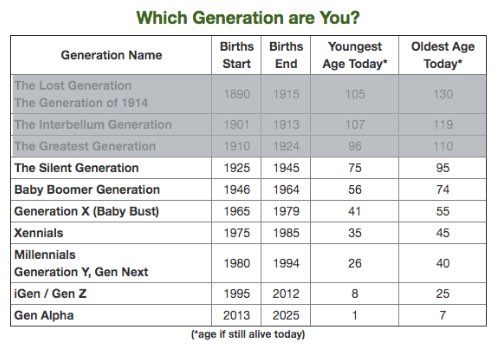

BEFORE COVID-19: Doing shopping from the mobile phone, seems to be the things that people from Gen Y and after has been doing for a long time. As for people from Gen X and before, buying things online is more leisure then necessity

DURING COVID-19: this is no longer the truth. Many of the older generations start to go online to get items that vary from basic necessities such as groceries to other non-essential items.

Exercising

BEFORE COVID-19: People going to the Gym to have their workout. Going to the stadium for their daily runs and more.

DURING COVID-19: People are doing exercise from home, in front of the TV via YouTube, etc… … …

Internet

BEFORE COVID-19: Internet lagging is fine, I have my mobile data plan

DURING COVID-19: I can’t take it anymore. The Internet is far too slow

Home Base learning

BEFORE COVID-19: Students are rushing to school every morning, with parents busy preparing their child and sending them to school.

DURING COVID-19: Children are staying at home, facing the computer to attend their lessons, and doing homework via the Internet Portal.

Working From Home

BEFORE COVID-19: Parents rushing to work after sending children to school, grabbing breakfast while on the way to work,

DURING COVID-19: Sitting in front of the computer, replying to emails while having breakfast.

I believe there are more things that have changed over the past few months. We have accepted and started living with the change. However, how has this change impacted me?

A recent survey has been done on 28th April 2020, over 2700 employees show that most employees are keen to continue working from home even after the Covid-19 circuit breaker.

What is the Impact Due to CoVid-19

CoVid-19 has had a huge impact on the financial sector, however, to what degree is the damage? There is no clear timeline as to how long this pandemic will last.

The direct victim of the impact would be Labour, Business owners, and Revenue

Labour

Organizations are being “forced” to have employees working from home. As we know, the operation of an organization is dependent on humans. Humans contribute to the functioning of the organization leading to revenue generated.

This switch in the labor pattern can potentially lead the company towards something that is known as a Gig Economy.

Those organizations that are heavily involved in the Gig Economy before CoVid-19 include

Food Delivery – Grabfood, foodpanda, Deliveroo and etc… … …

Online shopping – Fairprice Online, redmart, SingPost and etc… … …

Transport System – Grab, Gojek

During the WHM (work from home) model. Many companies are also put into a situation where they have to readjust their operating model, identifying what is working and what is not.

Thus, this leads to an increase in the unemployment rate. Those retrenched employees, in-turn, switch to providing services in the Gig Economy.

Business Owner

In the earlier paragraph, I shared that companies re-look into the operating model, slicing off extra resources to ensure the organization works with the leanest resources delivering the utmost results.

These company are also seriously looking into using technology to help deliver higher productivity. The aim is to achieve, the same Return of investment if not, lower investment.

There is a sharp increase in the use of cloud-based Collaborative Tools. Tools such as Zoom, Skype, video conferencing(VC) solutions are being used, to replace the regular meetings that happen in any organization. Cloud storage such as Google Drive, Dropbox, OneDrive, etc. is being used to fulfill their document transfers.

Employees that are unable to keep up to the paced will be dropped off. These groups will end up becoming unemployed staff.

With the use of those technologies, companies have successfully transferred their CapEx. Which is a large upfront investment to OpEx, which is a running cost model. This gives the business owner, a better sense of cash flow control.

Revenue

With the infecting of Covid-19, there has been a significant decrease in sales across all industries, with the decrease in sales in some industries, going up to as high as 75%. With that drop in sales, all companies would be looking at ways to reduce costs to ensure sustainability.

Some considerations would be a reduction in rental space, closures of any non-profiting outlets, pay cuts, etc… .. …

What is the Impact on Real Estate

Real Estate, in many situations, is a very unique class on its own. Although it is impacted by the global/local economy, it may not be relative. Sometimes, the impact can be reversed.

In Real Estate, you have the traditional stuff like office, retail, residential, and industrials, that are available for you to invest or “trade”. However, is now the right time to invest in those spaces?

Office

With the earlier survey taken, as employees preferred to be working from home, employers do not require the same amount of office space, hence, there could potentially be an oversupply of office spaces in Singapore after CoVid-19.

They might be looking at downsizing the current spatial requirements to reduce rental investment, which would lead to a lowering of operating expenses.

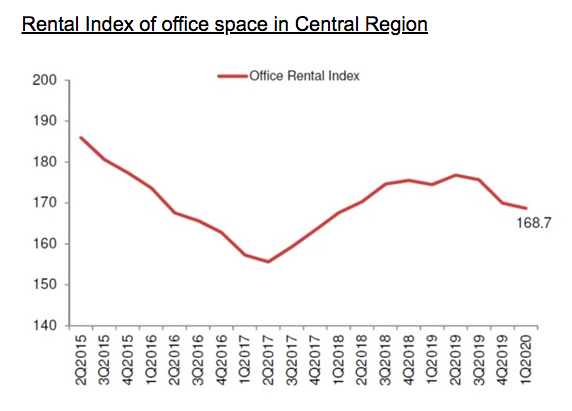

Office space rentals decreased by 0.8% in Q1 2020, as compared to a 3.2% decrease in Q4 2019.

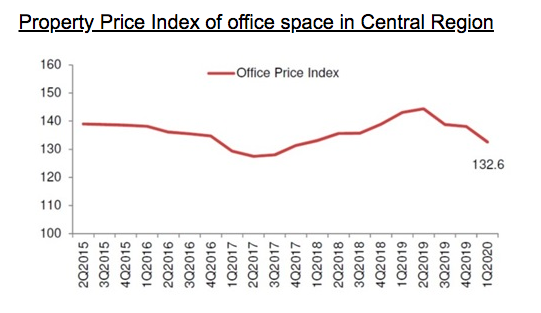

Prices for the sales of office space has also decreased by 4.0% in Q1 2020. As it compared with the 0.5% decrease in the Q4 2019

Retail

Covid-19 has changed the shopping culture of most people. Online shopping became part of our lifestyle. Ordered items will be delivered to our doorstep.

The space required for retail will potentially drop and there might also be a potential decrease in the number of people visiting the mall.

With the drop in requirement of retail space. The landlord will potentially switch those retail space to an F&B space, with a smaller footprint.

Residential

As real estate events are now classified as non-essential services, the regular viewing process cannot take place. Many buyers and tenants are not willing to commit without being able to view the units

Thanks to Technology today, buyers are now able to view the potential units online and still commit to their interested units. It goes the same for the tenant, where they can have a sense of the internal layout and offer an LOI (Letter of Intent) to the landlord.

Seeing what technology has done to assist in the buying and renting process, the residential property is still on the move. It is not going as fast or as smoothly as it was before CoVid-19, but for sure, it is not still.

Therefore, as everyone needs a roof over their head, be it local citizens, or expatriate that has come from other countries, the requirement for residential property is still a demand. The transaction is still happening, although it is slow, it’s never still.

Industrial

Like Office and Retail spaces, industrial spaces are also challenging for now and even after Covid-19. office spaces are still required by the organization. But, the upside of industrial is, it is better than Retail and office space

Why my opinion is so, the reason being that industrial is kind of hard to “downsize” or switch. For example, a car repair workshop requires that space for the repair of cars. The space required must minimally be able to fit the car into the workshop.

Another example is, heavy industrial dealing with stainless steel requires a minimum size so as to have their machinery in-place to do the job. As long as they are operational, they will require that working space.

Conclusion

In Conclusion, real estate in Singapore will never die. With that limited land area of 721.5 KM square. We will be housing, to-date close to 5.7 million people. Singapore is looking into having 6.9 million in population in 2030, 10 years from now.

Therefore, that incremental of 1 million population will have to “stay” somewhere. Therefore, as I have shared above, residential can go slow but it will never die.

Property investment into residential property is still showing good prospects as a rental will still be of demand. 1 million population in 10 years will not be through organic growth, a big portion it will have to be migrated in.

You have dive into the detail. Agreed that coved-19 is going to be here for awhile. We can’t wait till all over.