Why should I Invest During Covid-19 Crisis

Table of Contents

Crisis

For most of us, investment is usually the lowest priority when we are experiencing an extraordinary global crisis, as we are unsure of the current situation.

The most common concern is, if I invest now, would it drop further? This mindset is not wrong, however, if this is what you are thinking, you should not consider yourself to be an investor, as an investor is someone who is willing to step in with a manageable and predicted risk planned.

Before the crisis became certain, it was a very good idea to plan ahead and decide what your investment strategy is. Now that we are approaching the last part of the Circuit Breaker period, I am seeing that we are starting to work on having our economy recovered as soon as possible.

There are also news saying that we are going into recession, or maybe that we are currently already in recession. Recession is something out of our control, so why are we not taking this opportunity to invest on something that we could potentially appreciate after the recession?

Recession does not mean to stop all investment. It means, we are to be more careful in investing. In the market, 2 common investments that many talk about are, investing in Shares and investing in property.

A simple guideline to see which to invest can be, investing in share, most likely a short term and investing in property is very much a longer term.

Of course, being a realtor, I will still be recommending investing in property. Some of the reasons being,

- You will still be having income, to support your mortgage repayment. Worst case situation, it may not be all, but there will still be support

- You will get back your investment, if you sell your property at the right time . Especially in Singapore, with the limited land size. the chances of Singapore property prices to be on the up is higher.

Key Impact on Asia Property Market During Crisis

SARS

SARS happened between 2002 and 2004. During this period, many of us were more concerned with the infection rather than the investment, but the market never stopped because of that.

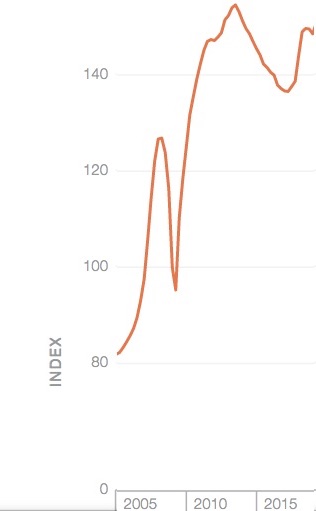

Let us do some analysis on the price index during the SARS period. Based on the chart, the price index moves down, in the year 2000.

That is 3 years before the SARS infection. The reason for the year 2000 dip in the price was the bubbling of dot-com.

You might be aware, dot-com, which is the Internet, was booming in late 1990. It has caused rapid growth in the U.S. technology stock. Many venture capitalist(VC) came in and supported them.

In the year 2000, the dot-com bubble burst and it affected the market globally. Singapore was also affected and during that period, many of the dot-com company was forced to cease their operations

Global financial crisis

15th September 2008 was an unforgettable date for many people, especially for those in the investment and financial sector.

On that day, the Lehman Brothers filed for bankruptcy, with a debt of 613 billion. It was the largest bankruptcy filing in U.S. history during that time of filing.

Looking at the private property price index during the Global Financial Crisis, the market came down after the announcement of the Lehman Brothers bankruptcy.

The market has made a return within 2 years. The chart indicates that, in the year 2010, the market has come up and it went on continually for a few years.

For those that have been in the property market, or been following closely on the market price index, The price went on an uptrend till 2013. The coming down of the price post-2013 was due to other reasons, as there were 2 financial crisis in the year 2013 and 2015, but it did not affect the market much.

Covid-19

The Covid-19, also known as the Coronavirus was first identified in Wuhan, China. This virus snowballed wordwide, and it was declared as a public health emergency of International concern by WHO (World Health Organization).

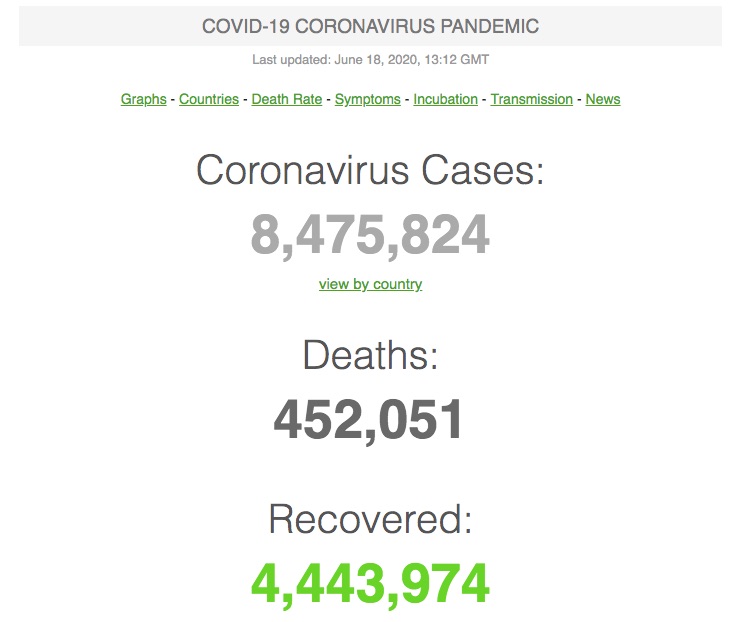

On 11th March 2020, it was being announced as a pandemic. As of 18th June 2020, more than 8.4 million cases across the world with over 450,000 deaths.

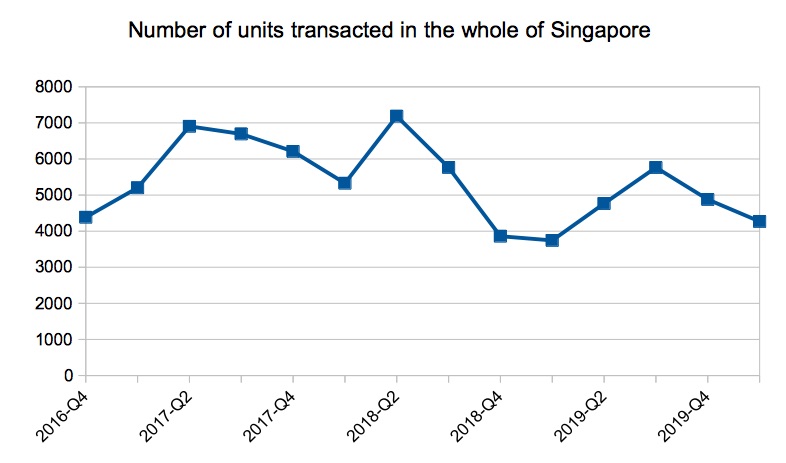

Looking back into the Singapore property market situation. After Q1 of 2019, the number of transactions has been on the rise. As of last quarter, which is Q1 of 2020, despite the Covid-19 situation, the transactions have not gone below what happened a year back. As in Q1 2019, there isn’t any crisis.

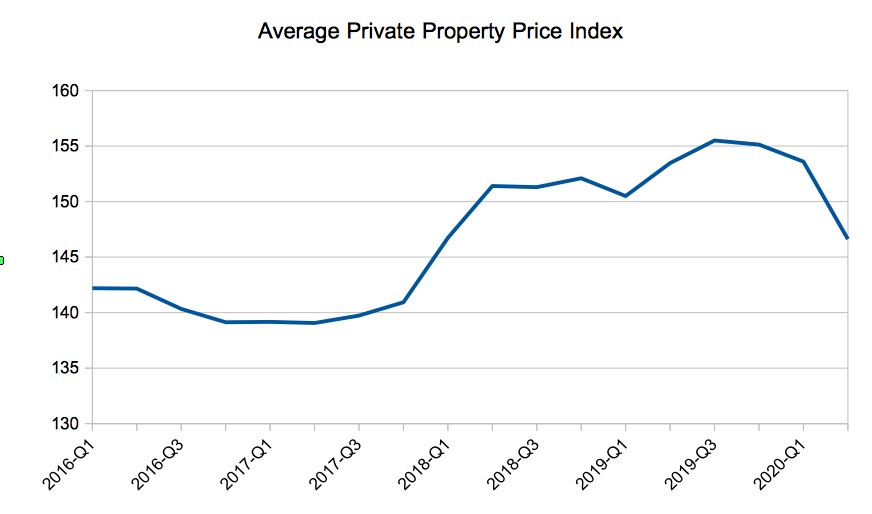

As for the price index. The average price index across all 3 region, which is,

CCR – Core Central Region

OCR – Outside Central Region

RCR – Rest of Central Region

areas are as follow

Since 2016, the price has been moving between the price index of 139 to 142. After Q4 of 2017, the market has picked up. Since then, The price index has never dropped below 150.

In Q1 2020, which is the period of Covid-19, the index has come down in comparison to Q4 of 2019, but it has not past the price index of 150.

Analysis

With the analysis of the price index, personally, this is still a good time to invest in property in Singapore with the following considerations:

Economical Stability of Singapore

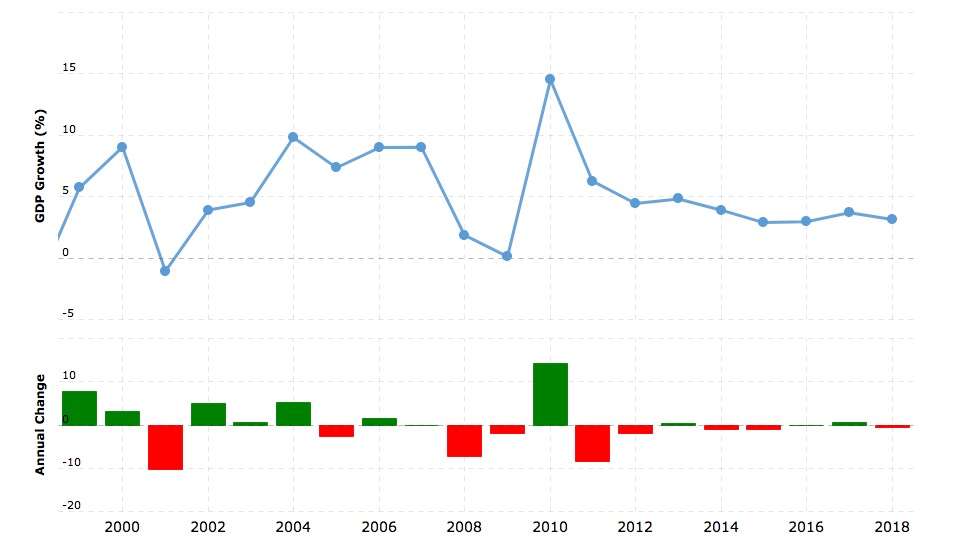

Singapore has grown to be a first world country in a short time of 30 years. We have proven our economical stability. Since the year 2001, we have been achieving positive GDP growth.

During the above mention crisis period, which is SARS between 2003 to 2004, Lehman Brothers in the year 2008, Singapore is still going strong in growth.

Limited Land Size

With the total land size of 792 square meters. Singapore makes sure that the property process is gradually being appreciated. The government controls the release of land accordingly to the needs, hence, this will not create sudden supplies of land leading to price crashes.

The alternative land supplies will be through the en-bloc process and developers who wanted to en-bloc any of the existing projects will need to consider, the market situation and the cost Vs the land released by the government.

Capital Gains and Property Inheritance Tax

Singapore property transaction does not exercise capital gain tax. Which means the profits that are made though the investment in properties are not liable for taxation.

This gives the investor, like yourself, the freehand to decide how much profit you wish to make from the property, basing on the market situation.

Property Inheritance Tax, which is also known as estate duty, is the tax charged on the total asset value of the deceased. This tax was being waived for the person that passes on after 14 February 2008. Since you are reading my article, you are not liable for this tax.

Conclusion

Singapore, due to the land size, the stability of both economical and political and development growth, has created a very unique situation for investor.

Be it good or bad time, investor are always keen in considering investing in Singapore. Taking the current Covid-19 situation, I strongly believe Singapore will be able to maintain, if not better the property market situation.

We might be seeing some headwinds for now. This potentially is a good opportunity for investors like yourself to enter the market while the prices are still soft.

Once we have moved out of the current crisis, as we have already gone into phase II of opening from Circuit Breaker. The price might have gone upwards, leading to higher investment amount for the same property.