Should You Buy HDB That Is Over 40 Years Of Lease

Since 1960, HDB was formed to provide public housing. Over the years, it has played a huge part in providing majority of the Singapore citizens with a roof over their heads.

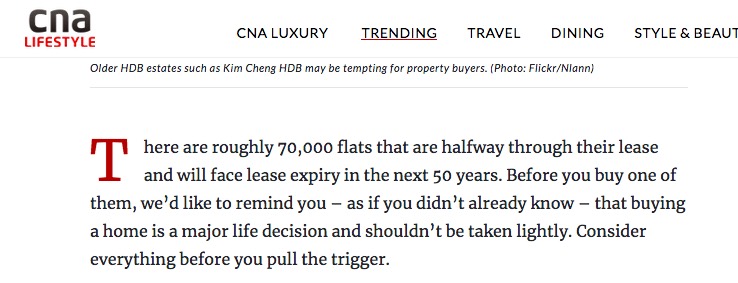

To date, there are about 70,000 HDB flats that have passed the mid-age of the property. These households will be facing the expiry of the lease in about 50 years’ time. Once these properties have reached 99 years of lease, it will be returned to HDB. This has yet to happen, and many would say that 50 years is still a long way to go.

However, given that the current flat that they are living in has already passed 40 years, 50 years is not too far from today.

Should I be buying these HDB Flats?

In many situations, there is no fixed and hard rules to that. There are always 2 side of coin and let’s discuss it.

Is the older HDB flat cheaper?

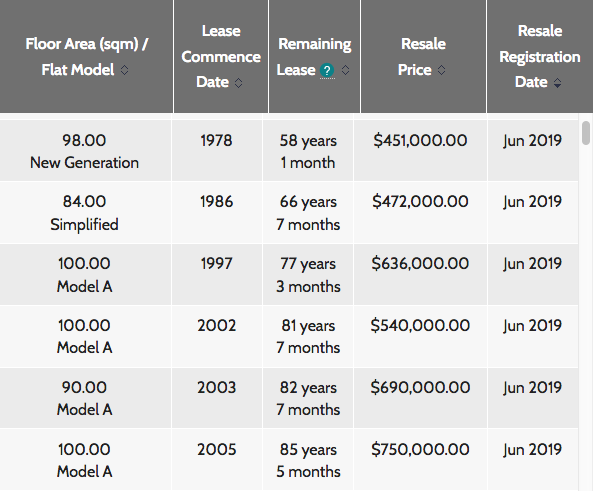

Generally, the older flat, especially those that are over 40 years of age are worth lesser. This is because the amount of “effective age” of the property is lesser.

Taking a 4 Room flat in Bukit Merah for example. In June 2019, the flat with a remaining of 58 years (Lease commence in 1978) was sold at $451,000. During the same time, the flat with a remaining of 85 years (lease commence in 2005) was sold at $750,000.

Although the value of older HDB flat is lower, this also makes the older flat more affordable. This would allow buyers with a limitation in budget to more easily own a flat.

Loan Availability

CPF has revised the ruling in May 2019, with the revision being, as long as the remaining lease of the flat is able to cover the youngest buyer up to the age of 95, they would be eligible to obtain a loan from HDB, capping at 90% of the Loan-To-Value(LTV). This has overwritten the flat of fewer than 60 years of lease left.

The retirement age of Singapore citizens is 65 now, there is a gap of 30 years to the loan duration. The ability to service the loan past 65 years of age, can be challenging for some.

Although the age for retirement is stated at 65, there are organisations who would not renew employment of staff once they have passed 62 years of age. This extends the 30 years by 10%, making it 33 years.

Is Older HDB Flat Bigger?

The HDB Flat that was built in the 90s were of 100 to 110 sq meters in size, compared to the newly built BTO flats today that ranges between 90 sq meters to 100 sq meters in size.

Unless you are comparing flats that were built in the 70s or 80s, if not, the size of the flat is comparable in the past 20 years. 4 Room flats, for example, ranging around 100 sq meters with 10% torrent.

HDB Looks OLD

As the name mentions, it is over 40 years of age. The design of the HDB flat would be old. However, in the aspect of design, there are two different perspectives that we can view it from; Internal and external.

Internal refers to as the design within the flat. The old look may not apply too much here, as the design inside the flat can be determined by you and it can be done up during a renovation process.

As for external, I do agree that the design for older HDB flat is the best during the time of built. Now, looking back, the design is not as modern as it is.

Higher Maintenance Overhead

Anything that has aged, it will require a have a higher maintenance overhead. Regardless of whether it is property, cars or machinery, etc…

Yes, the old property does require more maintenance efforts, and in many cases, the cost of maintenance is high.

For external maintenance issues. it would be resolved by the Town Council and the cost is from the Service & Conservancy Charges (S&CC). This amount is paid monthly by the HDB owner.

Internal maintenance would usually be fully covered by the owner. However, there are exceptions where I have personally encountered when my client seek my advice.

Case Study

My client has shifted into the purchase property 2 years ago. the age of the flat has past 34 years old. For those flat, that was built during the 80s. The rubbish chute is still accessible from inside the flat.

during the regular washing of the chute, which is done by the town council. Water starts to seep into the flat. I have assisted them to report the case to Town Council and they responded quickly with some professional.

Within a week, the vendor awarded by Town Council came by the flat and got it repaired. It was a massive work, whereby they will drill holes on the wall and insert some chemical into the wall to fill the gap.

The repair cost was pick-up by Town Council, the reason being that. The chute is common property and it is part of the S&CC cost.

SERS program

Selective En Bloc Redevelopment Scheme(SERS) is an Enbloc program for HDB flats.

When blocks of HDBs reach a certain age, the government will selectively repurchase these flats from the current flat owners. The owners will, therefore, be given an opportunity to select and shift to a new HDB flat with a fresh 99 years lease.

As shared, the block that is undergoing the SERS program is selective. NOT all HDB flats that have reached a certain age will automatically be entitled to the Enbloc.

Better Amenities

Being an old flat means the estate is more established and amenities are more convenient with better accessibility.

There are established MRT and Bus networks, with malls built nearby that are normally quite vibrant, with schools nearby.

Sometimes, if those above do not happen. Gentrification will be done in these estates to replace older amenities with a more modern style. In most of the older estates, the covered walkways are built to be more handicapped friendly as older estates tend to have a higher aged population and this ensures that their daily lifestyles are being well taken care of.

Alternative Plan Required

Should you decide to stay for long in the flat that past 40 years of age. You might need to have plan B. Reason being that the 99 years of the lease may not last you till the end.

Assuming you bought the 42-year-old HDB flat, leaving behind 58 years of stay technically to reach the end of the lease of 99 years. But, the preparation of the end of the lease for the land will happen at maybe 5 to 10 years before the 99 years.

This leaves you with only 50 years to stay in that flat. If you bought the flat when you are 28 and at the age of 78. You would be stressing over having a roof over your head.

Should the situation worsen, you would be at the age of retirement, where you could potentially have insufficient funds to purchase a new HDB flat.

As I have shared earlier, the price of the old HDB flats reduces as time goes by. Selling your old HDB flat, which is already 90 years of age, is not going to happen. I don’t think anyone will be keen on buying a flat that left with only 10 years of the lease, if not shorter.

Assuming you are lucky to have sold the unit, the amount of money returning back to CPF would not be able to cover the withdrawal amount, including the accrued interest.

Should you buy a flat that past 40 years of age

They are a list of pros in getting an old HDB flat. Such as the size of flat, amenities, lower price, near to parent, and more. But in the long run, the value of the flat is not on the upswing and it might pose as a bigger challenge should you decide to upgrade.

The list of cons is equally long. Some of the cons include the resales value of the flat, the affordability when it comes to upgrading, old age shifting of flat.

In the end, it goes down to the affordability. If you are a first-time buyer and financially sound, do consider purchasing a newer HDB flat. Those that are of 15 years and lesser, and potentially upgrading to private property after fulfilling the MOP of the property, this being that the property is of some value after your MOP and that path supports your upgrade. A CPF housing grant is also made available for you should you be a first-time buyer of an HDB.

If you still concern about the purchase of older HDB flat or any other queries you might have in relation to an HDB flat,

Do contact me at +65 90107188 or via WhatsApp here. I am most honored to share with you any concerns you might have and how you could move forward with a lower impact on the accrued interest.

Lewis became part of the family of Orange Tee and Tie in 2020. He has been in real estate since 2005. Together with him, he brought along a long history of experience in both HDB and Private property.

His personal belief is, to share the truth and facts with everyone. With that, he has good credibility with his client. His strong belief in a partnership and not the client made him successful in this career.