Must My Spouse A Singapore Citizen or Singapore Permanent Resident

Table of Contents

With many companies undergoing globalization, many Singapore citizens are traveling out of Singapore. Likewise, many foreign talents have also traveled into Singapore to work due to the skill set requirements.

With the movement of people between countries along with the improvement of technology, communication is no longer limited to IDD calls and emails. We now have better tools such as WhatsApp, WeChat, Telegram, LINE, and more, hence bringing people from different parts of the world together, and potentially becoming a couple.

As a couple going into the next stage of life, they would have to settle down in one of the 2 countries. Should they decide to settle down in Singapore, several options that they would have to consider in terms of housing would be; to rent a flat, buy a HDB flat, or buy a private property.

What options are present to the couple

Renting

Renting an apartment is the fastest option. They just have to find a place that is suitable, spell out their requirements to the landlord and they are able to move in and stay for the next 2 years. Approaching the end of a 2-year lease, they can decide to continue staying by negotiating with the landlord on the terms or move to another rented unit and continue for another 2 years.

The risk for the above is that should the landlord decide to sell the flat, a relationship with the new landlord needs to be re-established, and should they private property that they have rented, undergone an Enbloc process, they would be forced to move out. There is too much uncertainty.

Most importantly, the couple is helping to service the mortgage of the landlord property, which they are entitled to purchase a HDB flat.

Buying from HDB Resales Market

Since your spouse is neither a Singapore Citizen nor a Singapore Permanent Resident, you are entitled to purchase a HDB flat from the open market as you have never taken any grant or purchased a BTO flat from HDB. You may exercise your citizen entitlement, to obtain a grant from CPF.

Buying Private Condominium

You will be entitled to purchase from both the open market or the new launch of a private condominium. With this, there is no grant from CPF and/or HDB although you are a Singapore Citizen. You will be purchasing the market price on those units sold.

Buying Landed Property

You will be entitled to purchase landed property in Singapore. As the landed property is classified as private property, there isn’t any grant made available for the purchase.

What Options the Couple DOES NOT HAVE

Buying BTO

As the HDB Flat is purchase under the Non-Citizen Spouse Scheme, this scheme does not allow the non-citizen to purchase a BTO flat directly from HDB.

Buying Brand New Executive Condominium

The couple is not entitled to purchase a brand new Executive Condominium. However, they are allowed to purchase from the open market, an existing Executive Condominium that is over 10 years of age. The Executive Condominium, at this age, will be treated as private property.

What Benefits Do I get

For the purchase of HDB from the resales market, you will be entitled to the grant for the purchase. The following are the type of grants made available to the non-citizen spouse scheme:

Enhance Housing Grant

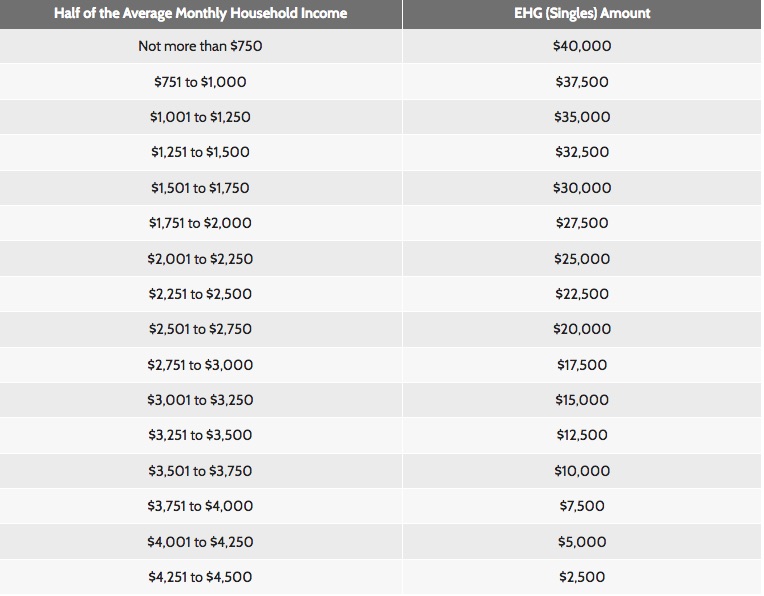

Depending on your monthly household income. The Enhance Housing Grant (EHG) is between $2,500 to $40,000. This amount was determined through an average of the past 12 months period.

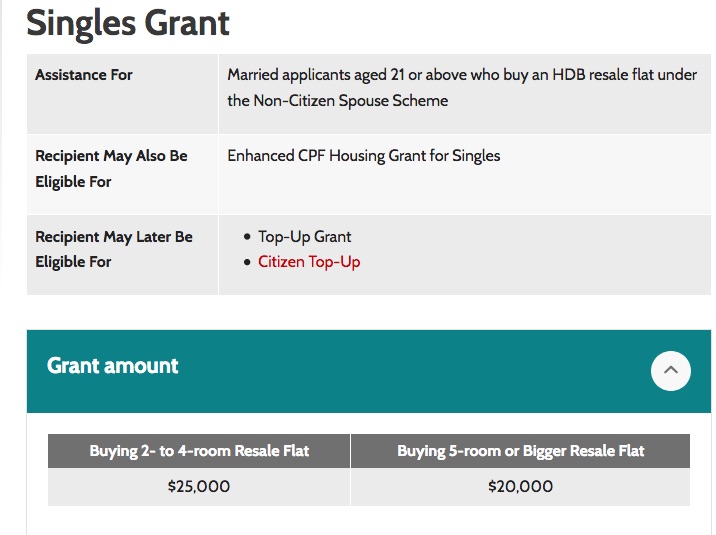

First Timer Grant

Being a first-timer buying a HDB flat, you are entitled to have your first-timer grant amounting to S$ 25,000 if you are purchasing a 2 to 4 room HDB Flat. However, in the event that you purchase a HDB flat from the open market that is 5-room and above, your total first timer grant is only $20,000.

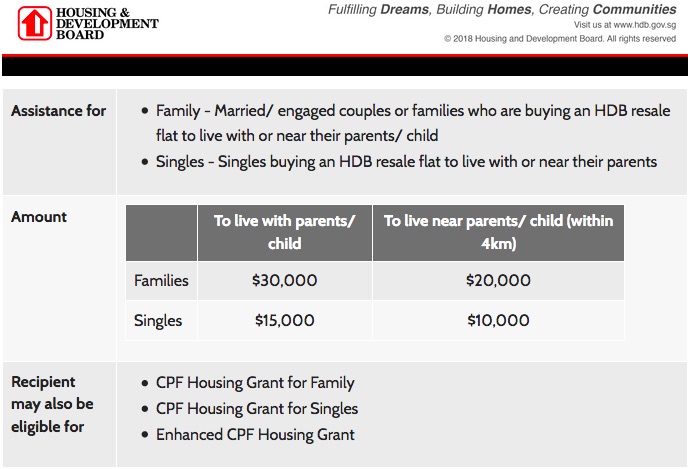

Proximity Grant

Should you decide to stay near your parents, there will be an additional proximity housing grant awarded to you. As your spouse is yet to be a Singapore Citizen, your entitlement will amount up to $10,000. But should you decide to stay with your parent, there will be an additional $5,000, leading the total grant amount to be $15,000

In addition, the distance between the flat you are buying and your parent flat has increased from earlier 2KM to 4KM. This gives you a wider range when it comes to selection in buying resales HDB Flat.

Another key requirement to obtain the grant is that the remaining lease of the purchased flat has to be 20 years or more.

Items to be Cautious

Payment of Resales Levy

All Singapore Citizen are entitled to 2 subsidized flats. In the event that you exercise your right to purchase the second subsidized flat, you will have to pay a resales levy for the earlier flat upon selling.

The positive side of this is that since you are getting only half the grant as a single Singapore Citizen marrying a non-citizen spouse, your resales levy will be half of the total levy.

Offset of down payment

Although you are entitled to the grant, the grant amount cannot be used to offset the down payment for the purchase of a flat. Should you require to have a down payment of 25%, this amount will still need to be paid, through CPF OA account or CASH.

Case Study

Recently, I assisted a newly wed couple in purchasing a resales HDB flat. Mr. Wong, which is the husband has married Ms. Zhang, a Chinese nationality early this year. They have been viewing many units of flat but was not able to commit on any due to their budget constraint.

Mr. and Mrs. Wong, age 30 and 32 respectively with a combined household income of $1,750 per month, was unable to purchase anything that is bigger than 3 room flat. Understanding his constraint, I worked with a banker, to ensure he got his loan approved.

At the same time, I suggested for them to purchase a 3S flat near his parent house. The purchase price of the unit was not higher than $250,000. This has given them limited options to select from, but it is not impossible. Through weeks of sourcing, they have managed to shortlist a unit near their parent in Circuit Road at a price of $250,000.

With the purchase price of $ 250,000 and his monthly income of $1,750 per month. He has obtained the grant with the following:-

First Timer Grant : $ 25,000

Enhance Housing Grant: $30,000

Proximity Grant : $10,000

The total grant obtained after the purchase was: $65,000. With his OA amount of $35,000 and cash $ 20,000

His total loan required will be $ 130,000 over 30 years of the repayment term. A monthly repayment amount that is affordable.

Conclusion

Although the marriage between yourself and the non-citizen spouse does form a family nucleus due to the fact that the spouse is yet to be a Singapore Citizen, the grant entitled amount will be at half the actual. Nonetheless, the spouse can request to top up when their Singapore citizenship is obtained. This will allow the top-up of the grant. The reverse is true, when it comes to payment of resales levy, the full amount will be payable in this case.

I will suggest that since you have obtained the half single grant and if it is financially affordable, to do an upgrade to private after the MOP period. This allows you to have more choices when deciding what to do after the upgrade.

If you are unclear. Do contact me at +65 90107188 or via WhatsApp here. I am most honored to share with you any concern you have and how can you move forward with a lower impact on the accrued interest.

Lewis became part of the family of Orange Tee and Tie in 2020. He has been in real estate since 2005. Together with him, he brought along a long history of experience in both HDB and Private property.

His personal belief is, to share the truth and facts with everyone. With that, he has good credibility with his client. His strong belief in a partnership and not the client made him successful in this career also.

Should you have any queries, relating to HDB. Be it Buying, Selling or consider to rent your HDB after staying for over 5 years. , or other properties that are of your interest to upgrade or invest. Drop me a WhatsApp HERE. I will respond to you soonest possible.