4 Questions To Ask Before Upgrading Your HDB

Table of Contents

4 Questions To Ask Before Upgrading Your HDB

You have been staying in your newly BTO HDB Flat for almost five years. Your neighbor has been talking about upgrading to a bigger flat, upgrading to a private Condo, profiting from the sales, cashing during the coming up-trend of the market, etc.

On many occasions, your discussion with your friends or relatives will be very much in the direction of upgrading to the private condo, your value better if you want to sell in the future. The best is to get a freehold condo. You have the facilities you need downstairs. You have full ownership and more

After talking to many people around you, all will be giving similar feedback, and you decided to upgrade. What is the magic question you will ask yourself or the realtor before you make those moves?

MUST I SELL MY HDB BEFORE I CAN UPGRADE

The answer to that is NO if you are a Singapore Citizens. you do not have to sell your current HDB flat before you can buy a condo in Singapore. Although you are given the option to own more than 1 properties, after buying the private condo. there is a financial impact which you will like to consider.

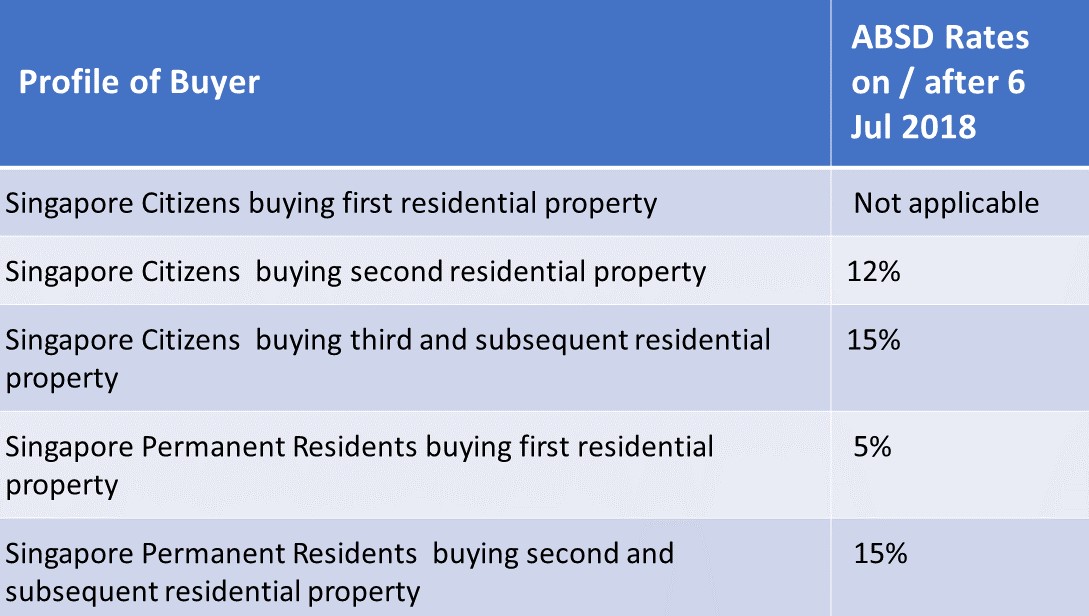

To own a second property in Singapore, there is an Additional Buyer Stamps Duty (ABSD) to be payable. Depending on the number of properties the HDB owner owns, the percentage of ABSD varies from 12% to 15% after 6th July 2018, depending on the number of properties the owner owns

HOW MUCH I MAKE IF I SELL MY HDB

Depending on your financial situation and also, your risk appetite, you might consider selling the HDB and upgrade to the private condo.

Once you have made that decision, the computation of HOW MUCH goes into your pocket I make upon selling my HDB, and can I afford to buy private Condo?

You realized, SingPass is very important now. Why, first, you will need to know, how much outstanding loan you have, if you are taking HDB loan. if you are taking a bank loan, you will need to check with the bank providing you the loan.

How do I check my outstanding loan, if I am taking an HDB loan? you will have to log in to the HDB web portal, i.e., www.hdb.gov.sg. After successful login, go to My HDBPage and obtain the outstanding amount indicated.

After knowing how much outstanding, you will now, find out how much you need to return to CPF, which you are using it to service your earlier loan. in the event you are using CASH to services you loan, this will not be required.

To obtain the total CPF amount used, including accrued interest. Log in to the CPF web site using your SingPass. Upon successful login, go to “My Statement”. Select “My Public or Private Housing Withdrawal Details”, which will provide you detail on the amount payable after selling your property

After summing the above 2 figures, you have computed the biggest ticket amount. with that, you can, therefore, make a quick decision, will your HDB, selling at the current market situation . will it be profitable for you. In a simple team, do you get back any money?

What are the taxes payable upon buying

In a purchase of Property, there are various tax payable. Inboard category, there are the following tax payable

Buyer Stamps Duty

Buyer stamp duty is tax duty payable, regardless of the number of the property you have prior to the purchase of the property. This payment is required once you have executed the sales and purchase agreement

If the benefit is stated in the document to be stamped and is a cash discount (i.e. cash, non-post dated cashier’s order or cheque) to be given to the purchaser upon execution of the document (and not later).

To know what is the total amount that is a consideration for stamp duty. The total discounted amount may be deducted from the purchase price. The final agreed price will still reflective of the current value.

If the document to be stamped stated a non-cash benefit to be given (e.g. furniture voucher, rental guarantee, car, or lucky draw), the value of the benefit is not deductible from the purchase price for stamp duty purpose.

If the cash or non- cash benefit is not stated in the document to be stamped, the value of the benefit is also not deductible from the purchase price for stamp duty purposes.

Additional Buyer Stamp Duty

The ABSD liability will depend on the profile of the buyer as at the date of purchase or acquisition of the residential property:

A. Is The buyer is an entity or an individual

B. The Buyer’s residency status

C. The numbers of residential properties owned by the buyer(s)

WHETHER THE BUYER IS AN INDIVIDUAL OR AN ENTITY

An entity means a person who is not an individual. It includes the following:

- An unincorporated association

- A trustee for a collective investment scheme when acting in that capacity

- A trustee-manager for a business trust when acting in that capacity

- The partners of the partnership whether or not any of them is an individual, where the property conveyed, transferred or assigned is to be held as partnership property

If a property is jointly purchased by buyers of different profiles, the profile with the highest ABSD rate will apply to the entire value purchased.

THE RESIDENCY STATUS OF THE BUYER

The applicable ABSD rate is based on the nationality of the buyer on the date of purchase. You must have been granted the residency status by the Immigration and Checkpoint Authority (ICA) as at the date of purchase in order to enjoy lower ABSD liability. The date of the issue reflected in the IC collection slip would be taken as when the residency status was granted.

THE COUNT OF RESIDENTIAL PROPERTIES OWNED BY THE BUYER

If a Contract or an Agreement to purchase the property has been signed, that property is to be included in the count of properties owned by a buyer from the date of acceptance of the agreement, even if it has not been legally transferred to him as he already has an equitable interest in the property.

This also includes the purchase of an uncompleted unit from the developer if the Sale & Purchase Agreement has been signed.

Similarly, the property is to be excluded from the count of properties owned by a buyer. If there is already a Contract or an Agreement to sell his property and the new buyer has executed his option to buy the property.

Should I use the same realtor for buying and selling

There is technically no right or wrong answer to use the same realtor in both your buying and selling of properties. In fact, there will be more benefits in using a single agent for both your buying and selling of your property.

TIME

The same realtor will be able to coordinate the timing of both buying and selling, that minimize running into the risk of “homeless” or “overpay”. This risk might potentially happen when using 2 realtors.

COST

Other than time-saving, as share earlier. the cost-impact will come in when the handing over of your sales units is earlier than your collection of the property bought.

This potentially leads to, an arrangement of short team stay is required, be-it, hotel stay, short term rental, etc…

NO DUAL REPRESENTATION

Dual representation in the context of real estate is, the same realtor is representing you, and the other customer on the SAME property.

In the case of representing the SAME customer on a different property, it will not be classified as due representation, rather trust in a seamless transaction of both buying and selling.

Is that what I need to know?

Sadly, there are more information and procedure required in both the buying and selling of your flat. By reading will give you many theory concepts, but when it comes to actual execution. There are always surprises that rises

To ensure a smooth and seamless transaction. Most importantly, a stress-free buyer and seller. Let the professional do the job.

Ring ME now @ +65 90107188 to have a sharing session on your expectations.

Alternatively, you can also SMS or WhatsApp me

Thanks for sharing. The info may not be as complete but it given me a good start and how can i move from now.

Good sharing. This was useful for me to kick start our decision in buying of my HDB flat. I have texted u and looking forward for the detail discussion