Who Should Do Mortgage Refinancing?

Table of Contents

Who Should Do Mortgage Refinancing?

For many Singaporeans, the flat we purchase usually does not belong to us for several years, the reason behind that being that we put our purchased flat on a mortgage, where we then do our monthly repayment to the mortgage.

The situation worsens if you are repaying through your Central Provident Fund(CPF), which many of us are doing. Why is it worst off? Without realizing, you are paying double the interest rate, as one interest goes to the mortgagee, and at the same time, you are also paying interest to CPF for withdrawal amount. If you check on your CPF account, you would realize after years of repayment that you will have an “accrued interest”.

Should I refinance My Mortgage?

For the refinancing to happen, your mortgage loan has to be from banks. Any loan from HDB does not entitle you to any refinancing. As long as you have fulfilled the criteria above, the answer to the refinancing is YES.

Refinancing With Lower Interest Rate

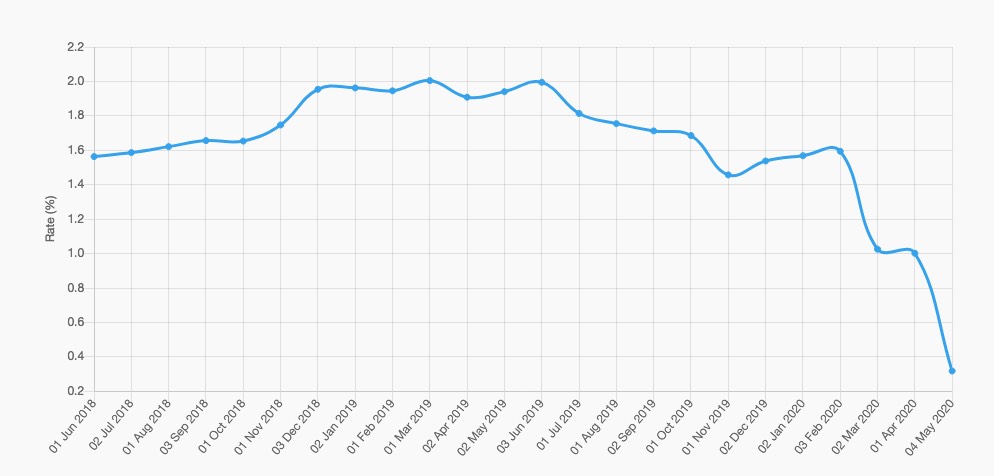

As the loan interest rate for Singapore property mortgage in packed onto the SIBOR rate, it is a good opportunity to look at the rate and decide when to do your refinancing of a mortgage.

Historically, the rate is on the downtrend, which means that with the same loan amount, you are paying lower interest.

Lower Repayment Amount

There are a few factors that would have a direct impact on the monthly repayment amount of your loan.

Firstly, the interest rate. Since the SIBOR rate has decreased based on the chart above, the computation of your loan repayment amount will be based on the revised rate. The total payable amount will be lower than earlier over the same repayment duration.

Secondly, your loan principal has also decreased the past few years as you have started repaying your loan. With that lower principal loan amount, the computation to the repayment would also be lower.

Shorten Total Repayment Term

Normally, when we first start any mortgage loan, we would look for the longest repayment term possible. This ensures that we are paying within our comfortable ability.

Never have we realized that these “slow and steady” repayments lead to a higher interest rate paid. With the refinancing of your outstanding loan and a lower loan amount and interest rate, we can consider repaying with the same repayment amount in a shorter duration.

Unlock Equity Financing

Equity financing, is a way where you used your property as a form of collateral for a sum of cash. The cash amount is relative to the value of the property

For equity financing to happen, all financial institutions need to ensure the following criterias are met.

Loan-To-Value(LTV)

For equity financing to happen, the LTV for the homeowners must be kept at 75% of the property value. This includes the outstanding loan secure on the same private residential property

Tenure Capping on Loan

For the equity withdrawal, your tenure is limited to a maximum of 35 years

Total Debt Servicing Ratio(TSDR)

Total Debt Servicing Ratio(TSDR), is a framework from the Monetary Authority of Singapore(MAS). It serves to safeguard the borrower from being over-borrowing which may lead to repayment difficulty.

TDSR is calculated using the formula : (Borrower’s monthly debt obligations / Borrower’s monthly gross income) x 100%. This drives to a percentage of his entitlement to TDSR.

In this formula, there is an element, which is the monthly debts obligations. This includes all debt obligation such as the following, but not limited to:

- Property-related loans, including the current loan being applied for.

- Car loans.

- Student loans.

- Renovation loans.

- Credit card loans.

- Any other secured or unsecured loans, including revolving loans.

Consolidation of Debt

Other than the mortgage loan, many of the homeowners do have other repayments every month. In some cases, there are a handful of homeowners who are having high-interest rate debts, such as credit cards (In many cases, is at 24%) or other debts.

Consolidation of debt, in this case, enables these homeowners to use the refinancing opportunity. Using the home as collateral to cash out funds in repayment to those credit card debts. The rate through the use of equity financing is of a lower rate as compared to some of those other debts the owner may have.

If the purpose of refinancing is to do consolidation of debts. There may not be any savings, should you look at total debts in totality. The consolidation of debts is to help them to overcome the struggling monthly repayment.

In addition, the consolidation of debts can also allow them to better manage the process of repayment of their monthly bills. Without the consolidation, these homeowners may be very much overwhelmed by their numbers of bills to be managed. The amount to be paid every month.

Even if the number of outstanding bills are not worrying, it takes time and effort to do the payment for all bills. With that, some homeowners might want to take the simpler way of doing the repayment.

Refinancing gives me all the benefit?

However, as in all situations, there is a flip side. Although there are the above benefits, there are also cons in doing refinancing of your property.

Property being collateral

Being a homeowner, when you put your property on collateral during the refinancing. If you, being the mortgagor, are unable, or refuse to repay the monthly loan, the mortgagee, in this case, the financial institution, essentially owns the mortgagor’s property

Therefore, if equity financing is your consideration, I will strongly suggest you work on the affordability. The comfortable level of repayment duration and amount before execution. Should you have any unclear concerns, do consult a professional.

Temptation

When you do equity financing to your property, you are like striking a 4D at that point in time. The main difference is, striking 4D does not require you to repay back but the refinancing requires you to do so.

Therefore, the mortgagee must be very sure of his/her purpose and intent of doing the equity refinancing. Some questions that may be asked are; What is the right amount you require? What is the repayment schedule and amount? Where is your source of funds to do the repayment?

Additional fee

The refinancing process is not just moving of blocks, and there will be parties involved in getting that done. To do so, there will be some fee payable.

Some of the required fees include legal fees. On average, it would cost around $3,000 just to complete the refinancing process. What you are paying is not limited to only the legal fees, and there are other fees payable by you such as property valuation fees, where a valuer is required to assess the value of your property to ensure that the worth of your property is of market value.

Although the interest rate is lower, there is a monthly saving, but do take note that there is a one-off payment required. These are some fees payable that you should take into consideration.

Before any decision, please speak to a mortgage broker. This would allow you to have a more detailed understanding, and would also give you a good understanding of how to crunch out all figures for you. If you are speaking to the financial institution broker, they can also help you with all the necessary paperwork if you are doing the refinancing through their financial institution.

Conclusion

Refinancing your mortgage required you to do some research beforehand. If you are not looking into doing equity financing during the refinancing of your mortgage, it will be very direct. As long the interest rate is low and the difference is able to recover your legal fee, it should be fine.

Should you want to do equity refinancing, there is more consideration on the Cons of the process. However, you may overcome these risks as the main risk to refinancing is the human factor. As long as you have the right aim and are well aware of the repayment amount and schedule, the risks are low and manageable.

There are many refinancing of mortgage available. Before talking to the mortgage broker, you may contact me for a discussion. I am neutral in the financing of your property. I am able to share with you an honest opinion.

At no obligations, I can be contacted at +65 90107188 or via WhatsApp here