Market Outlook – Q2 2020

Table of Contents

We have passed the mid-year of 2020. Within the first 6 months, there has been a few key economical situations, which have directly and/or indirectly impacted the property market.

Some key situations are

1. Coronavirus Pandemic Since Jan 2020

2. Singapore Declared Technical Recession on 14th July 2020

3. The unemployment rate increased to 2.9% in June 2020

The above 3 situations have placed many Singaporean in a very uncertain economical situation, especially so those in the workforce, where job security is his/her major concern.

Market outlook

HDB – Resales

Looking back – Q1 2020

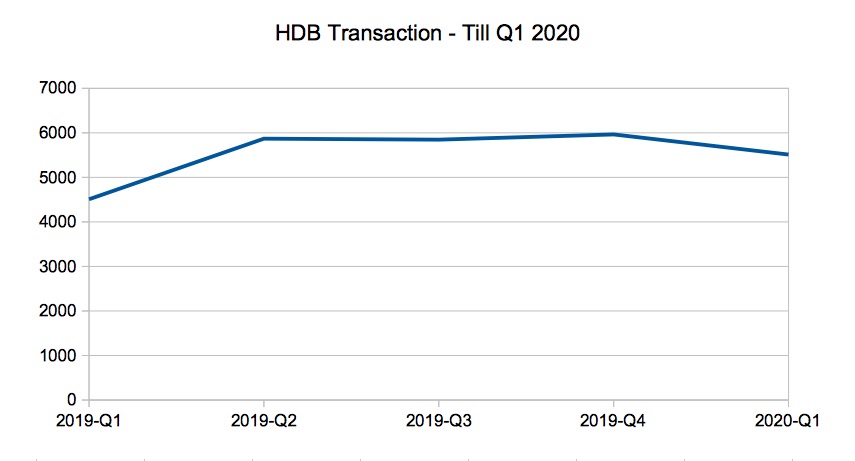

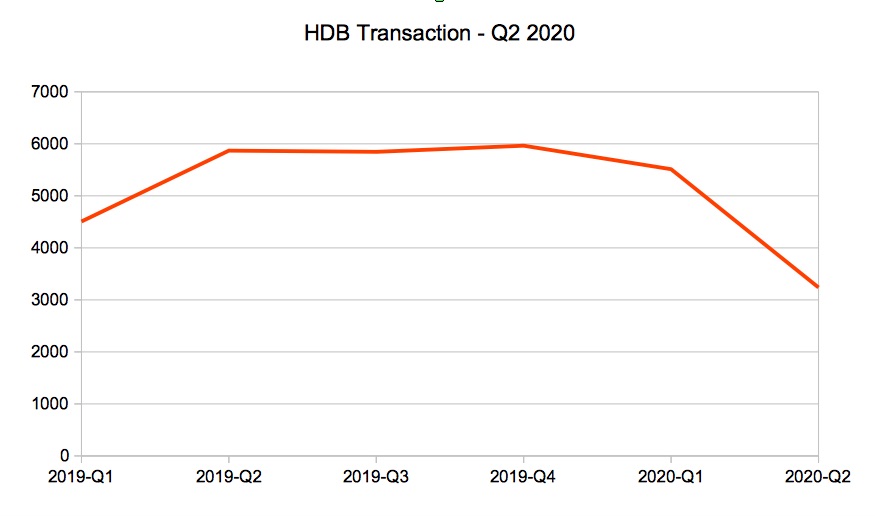

Since Q2 of 2019, the number of HDB transactions, regardless of flat type, has been fluctuating in the range of 6,000. This has been going on till Q4 of 2019.

Historically, the transaction did dip when it came to the beginning of the calendar year, which was sometime in January and February. Therefore, the moving down of the transaction in Q1 of 2020 is somehow expected.

The drop is the transaction for Q1 2020, from the statistic representation, is much healthier than Q1 2019, which hit a low of 4,500

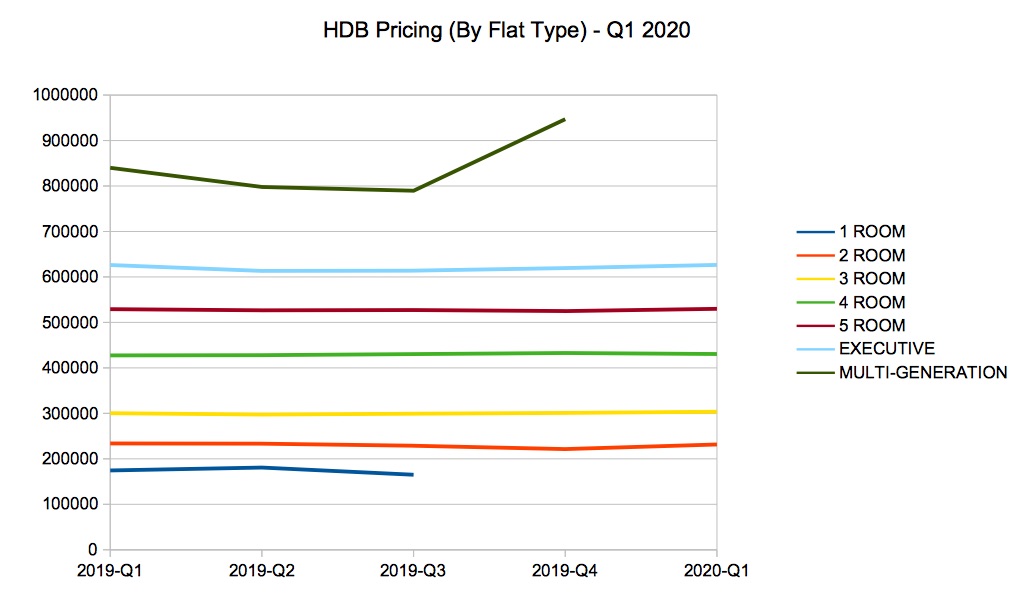

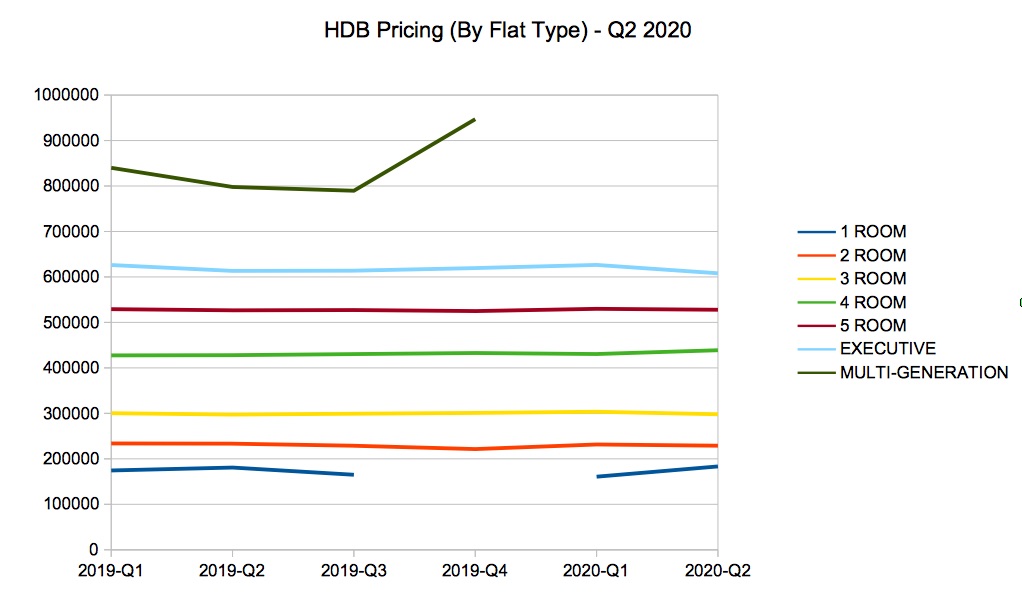

Looking from the price point perspective, all flat types are going very much constant, except for multi-generation. I will not take this flat type into consideration, as the requirement for this flat type is unique to a particular group of the buyers. This is also not to be used for benchmarking as the supply is limited to some of the HDB towns

Looking into – Q2 2020

From the transaction perspective, there has been a sharp drop in numbers from the earlier quarter of 5,500 units to Q2 of 3238 units. There are various factors leading to this dip.

The key factor was due to the enforcement of the Circuit Breaker in Singapore. The prelude of the Circuit Breaker started on 27th March 2020 where some of the entertainment venues were to close.

It further tightened on 7th April 2020, where non-essential services were not allowed. Real estate activity was, back then, classified as a non-essential service, and all viewing of the property was not possible.

There was not much of an impact on the pricing of the HDB flat, during the Circuit Breaker period. Looking from the chart, except for the bigger unit, which is the Executive flat type (ie, Executive Apartment and Executive Maisonette) that has dipped by 2.9%. the rest of the flat types are still going very much stable.

Future Sharing

With the relaxing of the Circuit Breaker on 2nd May 2020, real estate activities have recovered. The seller begins to allow the potential buyer to view their property and the buyers have started to source for their expected units.

HDB, being the public housing for all Singaporean, is always the first choice for those that are getting married. I foresee that the transaction will recover sooner than expected and it should be reaching the stable trend.

Private Property – Resales

Looking back – Q1 2020

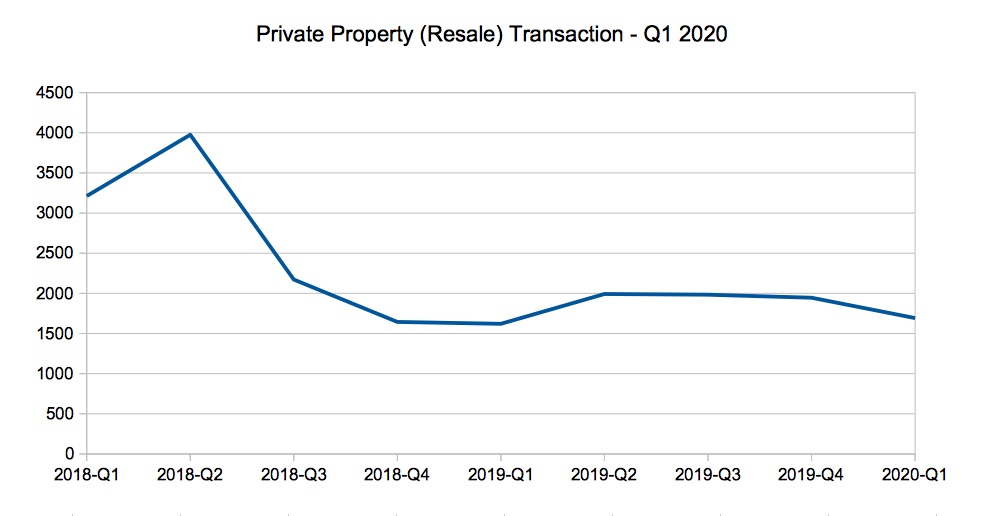

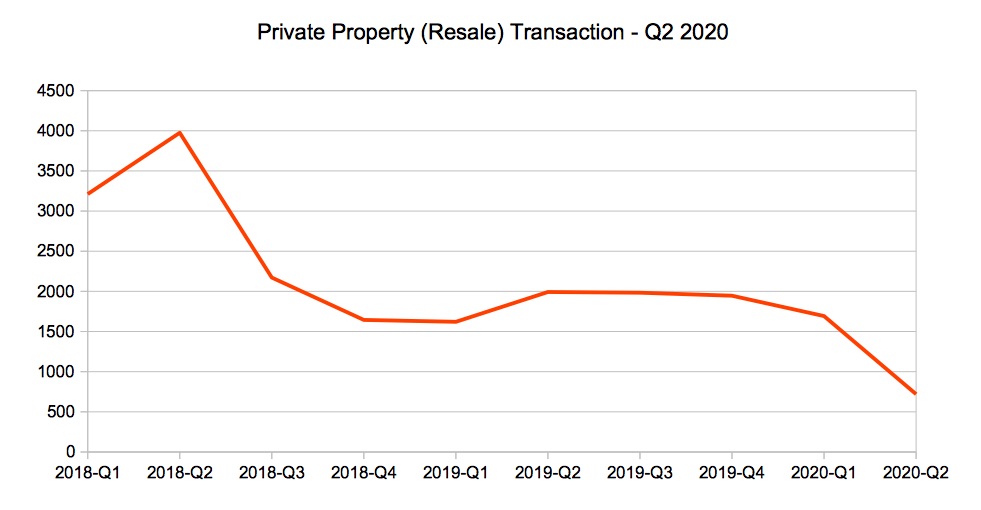

Transaction for resale private property has come down since Q2 of 2018. The drop between Q2 and Q3 has come to almost 50% drop. In numbers, it drops from 3,975 to 2,172 transactions within that quarter.

After the drop, the number of transactions have been moving between the range of 1,600 to below 2,000. These numbers have been constant for the past 7 quarters.

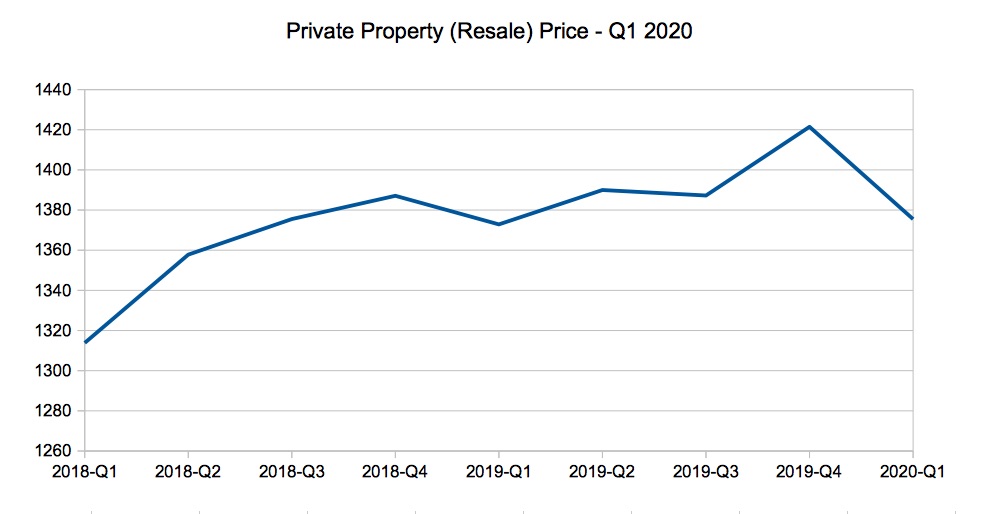

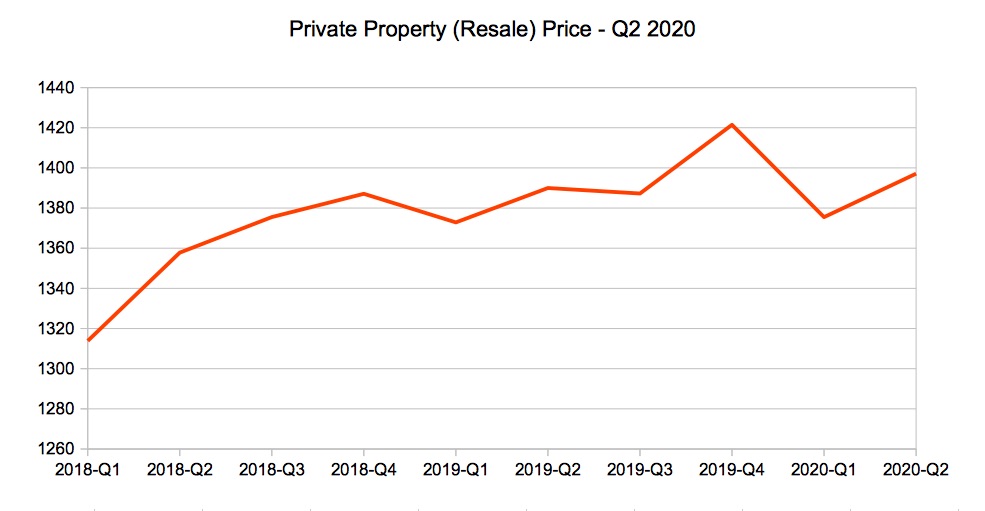

Although the number of the transactions have come down in Q2 2018 and remaining constant with a difference of 500 units between a quarter to quarter. The price of the transaction has been on an up.

During the initial drop from Q2 to Q3 2018, the price has come up from Q2 average per square feet of $1,357 to Q3 average per square feet of $ 1,375. The prices have been moving up since Q3 to the last quarter of 2019. Closing the year with $1,421 per square feet.

For Q1 of 2020, mainly due to the outbreak of Coronavirus, although not widely spread, has made many buyers aware, resulting them in holding back in offering any shortlisted property.

Looking into – Q2 2020

With the implementation of the Circuit Breaker in Singapore which started in April 2020, which is the beginning of Q2. The number of the transactions have dropped from 3,773 in Q1 to 2,398 in Q2. A total drop of 1,375 units. Leading to, in percentage, 36.5%.

The circuit breaker has created a very unique pricing situation for resale private property. The price during the Covid-19 circuit breaker period has come up. from $1,375 per square feet to $1,394 per square feet. An increase of 1.5%.

Future Sharing

As we are aware, Covid-19 is not going to end anytime soon. Many agents have capitalized on the use of technology to conduct showing of resales to the potential buyer. This approach has given more opportunities for the buyer to feel comfortable and safer when they wanted to view the unit.

I will think that this is going to be the next wave of trend in the property shortlisting process. It also saves the time and effort of the potential buyer. With this convenience, I foresee property transactions will be back on track soon, living together with Covid-19.

Private Property – New Launch

Looking Back – Q1 2020

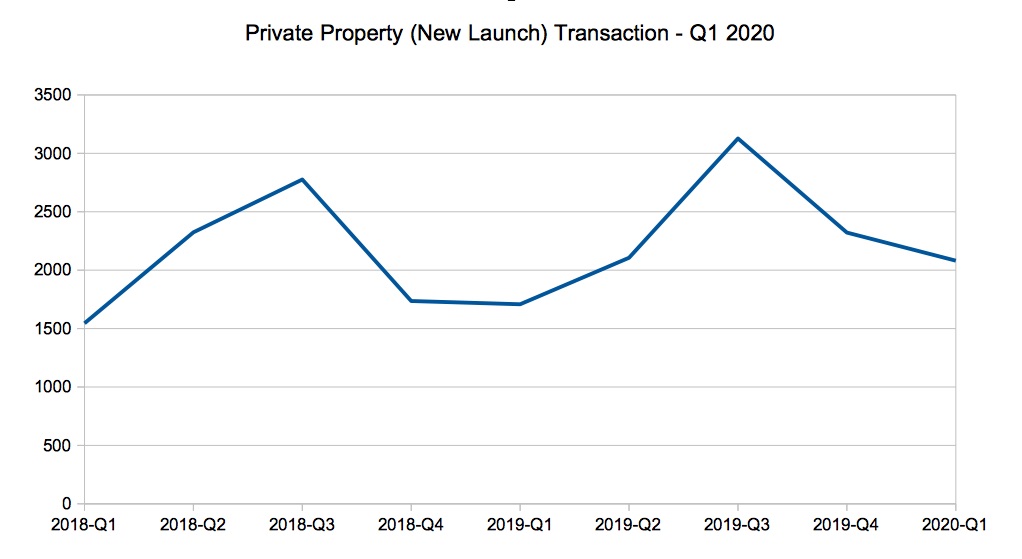

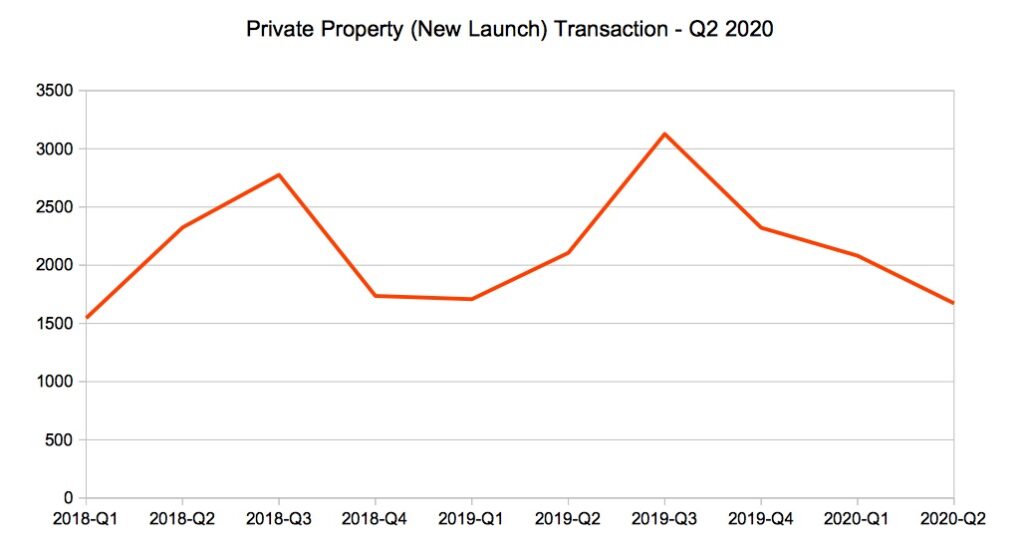

Transaction on new launches has been like a roller coaster since Jan 2018. It went up for 2 quarters, after which it came down, maintaining below 2,000 units transacted for another 2 quarters.

It swings up at a peak of over 3,000 during Q3 of 2019. The drop begins after Q3 and it went continuously down for 2 quarters, which the downtrend of Q1 of 2020 potentially caused by the outbreak of Coronavirus, leading to some uncertainty.

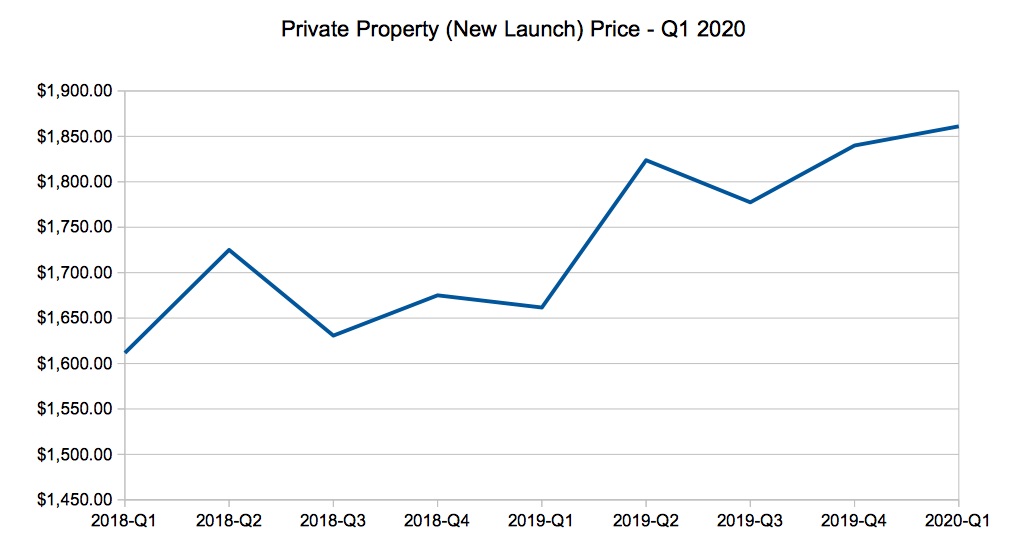

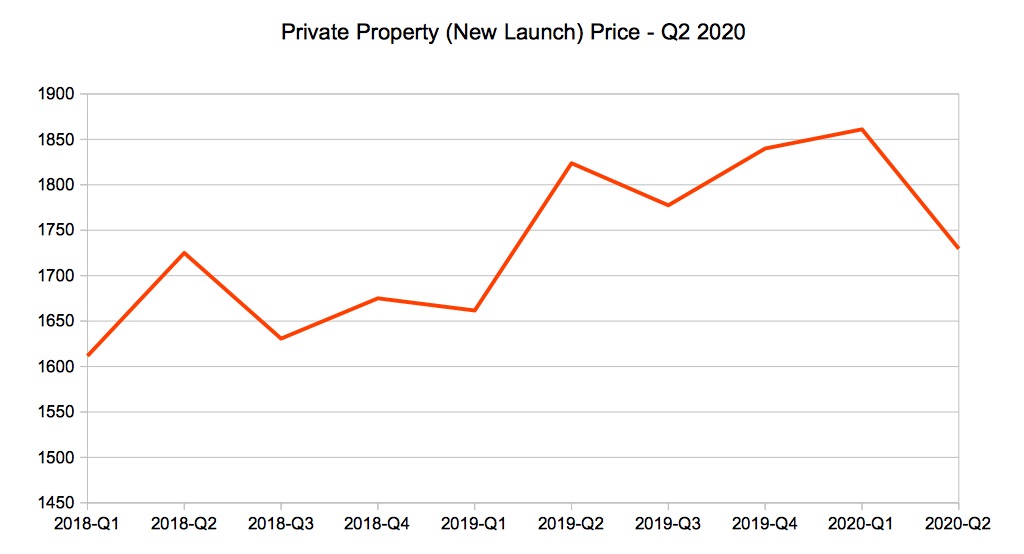

Prices for new launches do not get closely align with the number of transactions. Looking at Q3 of 2018, the number of transactions is on the up but prices have come down.

This trend goes the same for Q3 of 2019. Prices tapped down, although the number of units sold went up.

What has drawn my attention was the Q1 of 2020. With the outbreak of Coronavirus, the number of units sold came down, but the price per square feet went up, hitting past the average of $1,850 per square feet.

Looking into – Q2 2020

The numbers of units sold start to decrease since Q3 of 2019. This downward trend got worsen in Q2 of 2020 when Singapore went into the Circuit Breaker stage. Non-essential services were not made available leading to viewing at those new launched show flats not happening.

Unlike the resale private property, new launches prices have come down in Q2 2020. This largely was caused by the circuit breaker. The other possible reason is, the developer is reviewing their pricing to encourage the buyer to commit to those units that they are interested in.

Future Sharing

We have started to accept the fact that, Covid-19 is not going to be gone anytime soon. Therefore, property buyers and investors are now positioning themselves, to purchase the right units when the price and opportunity are right.

Also, developers and agents are now capitalized on the use of technology, such as video calls to meet with potential buyers, creating virtual show-flat for the potential buyers to view the units.

The developer has also invested in technology, to create a virtual show-flat tour for potential buyers. Accepting more electronic funds for payment of option and exercise fees and more…

Summary

Looking at the transaction numbers, the pricing of the properties in various segments of Singapore, athough the economic situation is not that positive, the real estate is still moving and transacting in a very healthy way

With the support of the chart and historical data, to date, the Covid-19 did not crash the real estate market. With the adjustment of the bank interest rate, there is more benefit to capitalize on these benefits and invest in the market for now.

I will not be able to speculate what is going to happen in Q3, and Q4 of 2020, but I am positive that it is moving in a healthy direction. Currently, while I am touching onto the market. New launches that are still coming on, and it is transacting well. Some good potential project has sold over 95% of their units and there are more, that has sold over 75%.

HDB owners are also taking this opportunity to upgrade. Be it to new launches or from the resales market. The demand for private property will still be stable.

“I am sharing these, based on my past experiences earned while participating in the market also, the data collected over the years. Hope this is of help to you, in deciding what you plan in the property market.”

If my sharing is helpful to you, and you will like to have a more in-depth discussion, I am most happy to have a session with you, at your best convenient time. Do drop me a WhatsApp to kick-start a discussion. Don’t wait till everyone has dived into the market, as it might be too late.